LIFE INSURANCE & LIVING BENEFITS

Insurance is the cornerstone of a strong financial foundation, providing the security needed to protect your loved ones from future financial hardships. Unfortunately, many Canadians are turning to crowdfunding platforms like GoFundMe to cover funeral costs and final expenses—an avoidable burden with the right preparation. A well-crafted financial plan, supported by adequate life insurance and living benefits, removes uncertainty and gives you and your family the peace of mind you deserve."

THE IMPORTANCE OF LIVING BENEFITS?

"Living benefits are unique types of insurance that policyholders can access during their lifetime, unlike traditional life insurance that pays out only after death. These benefits provide essential financial support in the face of major life events and even minor occurrences, ensuring stability when it's needed most. What sets living benefits apart is their unmatched coverage—going beyond what government programs, work policies, or personal insurance can offer. This powerful, standalone coverage steps in to support both expected and unexpected expenses resulting from accidents or illnesses.

Living benefits are the cornerstone of a secure financial foundation. They safeguard your future and provide peace of mind."

WHY DO YOU NEED LIFE

INSURANCE?

A well-structured life insurance policy is a powerful tool that creates a robust financial safety net for your loved ones in the event of an unexpected death. These benefits are meticulously crafted not only to cover your family's financial responsibilities, such as mortgages, credit card debt, unpaid bills, child care expenses, education for your children, large tax liabilities, and leaving a legacy for their future, but also to provide lasting financial stability for their ongoing needs. Thoughtful planning ensures that your family is supported during a time of grief, allowing them to navigate their loss with dignity and privacy, free from the burden of seeking public assistance for their financial obligations. By securing a life insurance policy, you are investing in their peace of mind and long-term well-being when it matters most."

When was the last time you had your life insurance reviewed?

As your life changes, so do your insurance needs. If it’s been a while since your agent reached out, let us help you ensure your coverage still meets your family’s needs—your peace of mind is our priority!

LIVING BENEFITS - Accident & Sickness

EXPENSES THAT YOU CAN COVER WITH LIVING BENEFITS

• Medical Expenses Not Covered: Covers treatments, medications, or specialized care that provincial health plans don’t include.

• Travel Expenses: Provides financial support for traveling to receive specialized care or treatments away from home.

• Child Care Costs: Helps cover the cost of childcare while you’re recovering or attending medical appointments.

• Time Off Work: Offers income replacement if you need extended time off due to illness or injury, ensuring your financial stability.

• Portability: Personal coverage stays with you even if you change jobs, get fired, or retire, unlike workplace benefits.

V

I HAVE COVERAGE AT WORK...

Most people believe they’re covered—whether through personal insurance, work benefits, or union plans. But these coverages are often riddled with gaps, leaving them dangerously exposed to income loss when life takes an unexpected turn.

Living benefits are specifically designed to fill these gaps, providing crucial financial support exactly when it’s needed most. Sitting down with an agent isn’t just a conversation; it’s an opportunity to uncover where current coverage falls short and the risks that come with it. Identifying and addressing these gaps can make the difference between staying secure or facing financial instability. Don’t wait to find out the hard way—take control and ensure your income is truly protected.

HOW CAN WE HELP?

• Accident, and Sickness

• 24/7 coverage, anywhere any time

• Supplemental, pays on top and beyond

• Covers you across Canada & The U.S.

• Outpatient / Hospitalization

LIFE INSURANCE

Life insurance should never be left to guesswork when determining the appropriate coverage amount or selecting the right type of policy. A one-size-fits-all approach cannot address the unique needs of individuals and families, and standardized solutions often result in insufficient protection. We believe every plan should be tailored, data-driven, and based on a thorough Expert Financial Analysis of your unique circumstances.

HARD TO INSURE COVERAGE

Securing life insurance can be challenging for individuals with medical conditions, especially if they’ve been denied coverage in the past. However, having a health issue doesn’t mean you’re out of options. We specialize in finding tailored solutions, including no-medical or guaranteed-issue policies, to ensure you and your loved ones have the protection you deserve. Everyone’s situation is unique, and we’re committed to exploring every avenue to provide coverage, even when it seems out of reach.

FINAL EXPENDSES

Final expenses, such as funeral costs, continue to rise with inflation and the increasing cost of living. It’s important to note that funeral expenses are typically due before or on the day of the service, which can place a significant financial burden on your loved ones during an already difficult time. Having a dedicated final expense plan ensures that these costs are covered, providing peace of mind and financial relief for your family when they need it most.

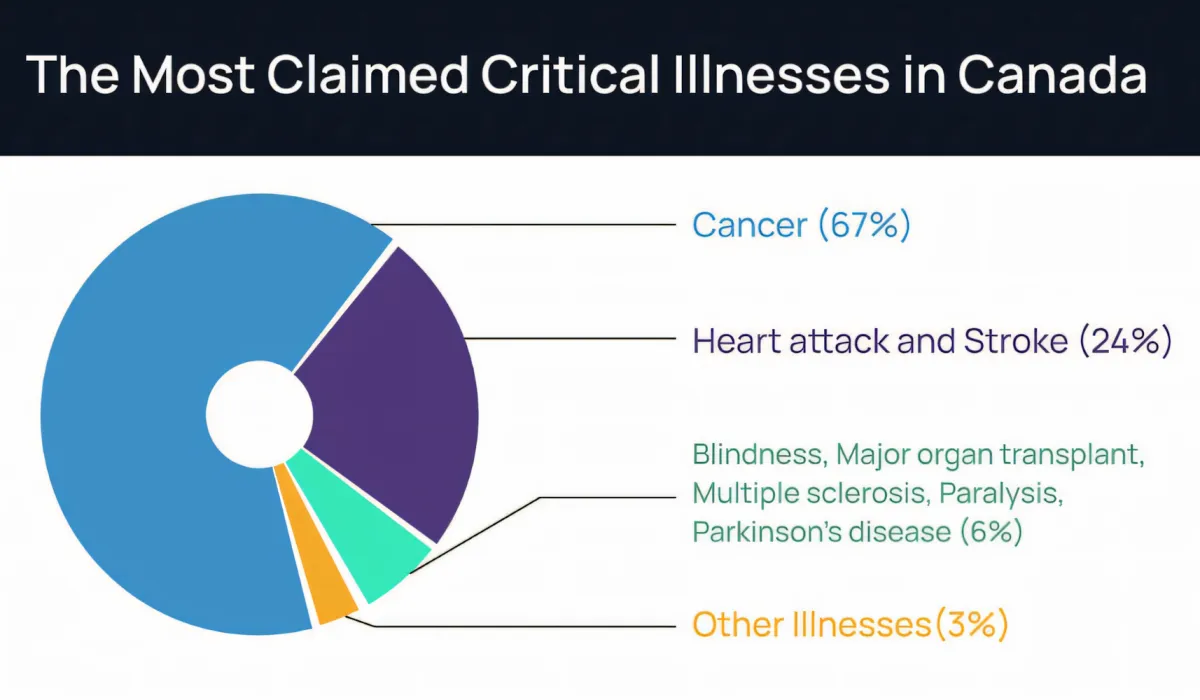

CRITICAL ILLNESS

Are You and Your Family Ready for the Unexpected?

Critical illness can strike anyone, anytime. In North America, 1 in 2 men and 1 in 3 women will face a critical illness. Thanks to medical advances, survival rates are high—but surviving comes with challenges like medical expenses, lost income, and recovery costs.

The big question is: while you may survive, will your finances? Prepare now to protect your future.

benefits of Critical illness

Critical Illness Insurance is designed to help you manage both your health and financial responsibilities during a difficult time. If you’re diagnosed with a serious illness like cancer, heart attack, or stroke, the policy provides a lump-sum payment to cover medical expenses, bills, and time away from work. This allows you to focus on your recovery without the burden of financial strain, ensuring that your health takes priority while still meeting your essential financial needs and responsibilities.

WHAT ELSE CAN WE SUPPORT YOU...

DISABILITY insurance

Taking time off work can be really stressful for you and your family. Disability insurance will help you to continue receiving your partial income (50% – 70%), if you injure yourself or get ill (subject to the specific insurance policy).

How does it work? If you are an employee and have benefits, your employer likely already provides some disability insurance for you.

However, it can be a smaller percentage from your income than you expected or the waiting period can be more than one year, in other words, you will start receiving your money if your condition takes longer than one year.

GROUP BENEFIT: Protect Your Most Valuable Asset - Your People

Group benefit insurance isn’t just another workplace perk—it’s an investment in your company’s success. By offering comprehensive health, dental, life, and disability coverage, you provide your team with the security they need to thrive. Group benefits leverage collective purchasing power to offer enhanced coverage at competitive rates, creating value for both your employees and your bottom line.

Ready to build a benefits strategy that works as hard as your team does? Contact us today for a free consultation and discover how the right group benefits plan can transform your workplace.

We would love to get to know you...

Let's connect!

I Consent to Receive SMS Notifications, Alerts & Occasional Marketing Communication from company. Message frequency varies. Message & data rates may apply. You can reply STOP to unsubscribe at any time.